Business Consultant, Expert on Fraud & Financial Ethics; Former Chief Financial Office of Enron

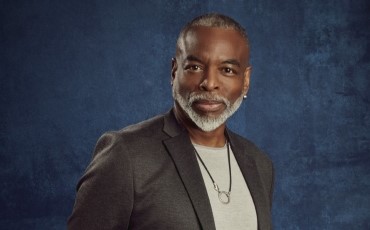

Andrew Fastow Biography

Mr. Andrew Fastow was the Chief Financial Officer of Enron Corp. from 1998 – 2001. In 2004, he pled guilty to two counts of securities fraud, and was sentenced to six years in federal prison. He completed his sentence in 2011, and now lives with his family in Houston, Texas. Mr. Fastow currently consults with Management, Directors, Attorneys, and Hedge Funds on how best to identify potentially critical finance, accounting, compensation, and cultural issues.

His training sessions focus on risk in the “gray area”, where decisions that may technically be allowed give rise to risks that are not being properly considered. He helps attendees to better understand the limited role of auditors and attorneys, how technically correct but ethically-challenged decisions may be interpreted by the “market”, and the steps that they can take to become more “self-aware”, so that attendees can better identify, price, and manage these risks.

Mr. Fastow is the only Enron executive that has taken full responsibility for his actions, and he has repeatedly and publicly expressed remorse. In addition to serving his prison sentence, Mr. Fastow forfeited far more money than he ever earned at Enron. He is credited with being the individual most responsible for helping to recover $6 billion for Enron shareholders.

Contact a speaker booking agent to check availability on Andrew Fastow and other top speakers and celebrities.

Andrew Fastow Speaking Topics

-

Unbiased: How to Manage Risk in the Gray Zone

We live in the Age of Corporate Disasters. From Enron to the financial crisis to Purdue Pharma, J&J, 3M, General Electric, Boeing, and Silicon Valley Bank today, and hundreds of companies in between, seemingly great and iconic companies have been harmed or destroyed by self-inflicted wounds. What has changed? Are we worse at Compliance? Are we less Ethical? Has Culture changed so significantly? The leaders at these organizations did not set out to do harm; their challenges arose from an inability to lead their teams through and to the right decisions in the Gray Area – that place where creative application of complex and ambiguous rules allow us to get to a technically correct answer that may be the wrong answer. The Gray Area is where leadership is needed most, but it is the area where leaders have the least amount of training.

Andy Fastow spent five years in prison thinking about his role as CFO at Enron. He is now a sought-after public speaker and he consults with Boards of Directors on ways to help leaders better identify, price and manage these unseen Gray Area risks in their businesses (and in their lives).

-

Rules vs Principles

Ethics is understanding the difference between what is right to do and what you have the right to do.

Fraud examiners, Auditors, Regulators, and Compliance experts look for “fraud”, but fraud is a narrowly defined term. Usually, these experts look for embezzlement, bribery, and the forging of incorrect financial entries. In other words, these experts look for employees who are “breaking the rules”. However, a majority of what is determined to be fraud “after-the-fact”, were actually decisions made by employees who believed they were “following the rules”.

The “traditional” definition of fraud does not include a very significant component of fraud, namely “loopholes”. Loopholes, simply stated, are contrived structures that technically adhere to a rule (or at least obtain an opinion attesting to technical compliance), but that contravene the purpose, or principle, of the rule.

Beginning in the 1980’s, there were two major systemic changes that gave rise to the “loophole” industry. The first was the advent of “structured finance”. The second was the explosion in the complexity of accounting, tax, and securities regulations. An industry comprising accountants, bankers, lawyers, and financial consultants arose to create financial structures that exploit this complexity, enabling companies to alter reported financials and to avoid taxes, all while “technically” complying with rules and regulations. Business executives now have at their disposal, an array of “legal” weapons that can fundamentally alter the appearance of their company’s financial condition.

When is it acceptable to engage in a transaction that technically complies with the rules, but that may be misleading? Can a transaction that technically complies with the rules be considered unethical or illegal? Is it ever appropriate to depart from GAAP or IFRS? Mr. Fastow will cite examples of such transactions at major companies, he will discuss the rationalizations made by executives to justify their decisions, and he will discuss examples of how these decisions can cause great harm to stakeholders. He will make suggestions of questions that Regulators, Auditors, Fraud Examiners, and Directors might ask in order to ensure that their companies not only follow the rules, but also uphold the principles behind them.

Finally, the former Chief Financial Officer of Enron Corp. will discuss his own story, and he will describe how he made such profound mistakes.

Andrew Fastow Videos

-

How do I book Andrew Fastow to speak at my event?

Our experienced booking agents have successfully helped clients around the world secure speakers like Andrew Fastow for speaking engagements, personal appearances, product endorsements, or corporate entertainment since 2002. Click the Check Availability button above and complete the form on this page to check availability for Andrew Fastow, or call our office at 1.800.698.2536 to discuss your upcoming event. One of our experienced agents will be happy to help you get speaking fee information and check availability for Andrew Fastow or any other speaker of your choice. -

What are the speaker fees for Andrew Fastow

Speaking fees for Andrew Fastow, or any other speakers and celebrities, are determined based on a number of factors and may change without notice. The estimated fees to book Andrew Fastow are $10,000 - $20,000 for live events and under $10,000 for virtual events. For the most current speaking fee to hire Andrew Fastow, click the Check Availability button above and complete the form on this page, or call our office at 1.800.698.2536 to speak directly with an experienced booking agent. -

What topics does Andrew Fastow speak about?

Andrew Fastow is a keynote speaker and industry expert whose speaking topics include Business, Business Leadership, College, Commencement, Corporate Strategy, Economy, Energy, ESG, Ethics & Integrity, Finance, Leadership, Marketing, Motivational, Overcoming Adversity, Strategic Leadership, Sustainability, Technology, Virtual -

Where does Andrew Fastow travel from?

Andrew Fastow generally travels from Houston, TX, USA, but can be booked for private corporate events, personal appearances, keynote speeches, or other performances. For more details, please contact an AAE Booking agent. -

Who is Andrew Fastow’s agent?

AAE Speakers Bureau has successfully booked keynote speakers like Andrew Fastow for clients worldwide since 2002. As a full-service speaker booking agency, we have access to virtually any speaker or celebrity in the world. Our agents are happy and able to submit an offer to the speaker or celebrity of your choice, letting you benefit from our reputation and long-standing relationships in the industry. Please click the Check Availability button above and complete the form on this page including the details of your event, or call our office at 1.800.698.2536, and one of our agents will assist you to book Andrew Fastow for your next private or corporate function. -

What is a full-service speaker booking agency?

AAE Speakers Bureau is a full-service speaker booking agency, meaning we can completely manage the speaker’s or celebrity’s engagement with your organization from the time of booking your speaker through the event’s completion. We provide all of the services you need to host Andrew Fastow or any other speaker of your choice, including offer negotiation, contractual assistance, accounting and billing, and event speaker travel and logistics services. When you book a speaker with us, we manage the process of hosting a speaker for you as an extension of your team. Our goal is to give our clients peace of mind and a best-in-class service experience when booking a speaker with us. -

Why is AAE Speakers Bureau different from other booking agencies?

If you’re looking for the best, unbiased speaker recommendations, paired with a top-notch customer service experience, you’re in the right place. At AAE Speakers Bureau, we exclusively represent the interests of our clients - professional organizations, companies, universities, and associations. We intentionally do not represent the speakers we feature or book. That is so we can present our clients with the broadest and best performing set of speaker options in the market today, and we can make these recommendations without any obligation to promote a specific speaker over another. This is why when our agents suggest a speaker for your event, you can be assured that they are of the highest quality with a history of proven success with our other clients.

Andrew Fastow is a keynote speaker and industry expert who speaks on a wide range of topics such as Unbiased: How to Manage Risk in the Gray Zone and Rules vs Principles . The estimated speaking fee range to book Andrew Fastow for your event is $10,000 - $20,000. Andrew Fastow generally travels from Houston, TX, USA and can be booked for (private) corporate events, personal appearances, keynote speeches, or other performances. Similar motivational celebrity speakers are Andrew Busch, Erika Cheung, Afdhel Aziz, Libby Gill and Daymond John. Contact All American Speakers for ratings, reviews, videos and information on scheduling Andrew Fastow for an upcoming live or virtual event.

This website is a resource for event professionals and strives to provide the most comprehensive catalog of thought leaders and industry experts to consider for speaking engagements. A listing or profile on this website does not imply an agency affiliation or endorsement by the talent.

All American Entertainment (AAE) exclusively represents the interests of talent buyers, and does not claim to be the agency or management for any speaker or artist on this site. AAE is a talent booking agency for paid events only. We do not handle requests for donation of time or media requests for interviews, and cannot provide celebrity contact information.

If you are the talent and wish to request a profile update or removal from our online directory, please submit a profile request form.